Do you feel like you missed your chance to buy a house? Mortgage rates have seemingly doubled in the past year and don’t show any signs of slowing down this year. While the news has everyone in a frenzy over the housing market’s increasing interest rates, there is no need to worry.

We have been working in Northern California and Nevada for over 35 years and have seen the ebbs and flow of the market. Don’t believe the buzz; it’s ok if interest rates are rising. We are here to help walk you through the process. Join us as we discuss why rising mortgage rates are not as big of a concern as you may have thought.

Historical Perspective

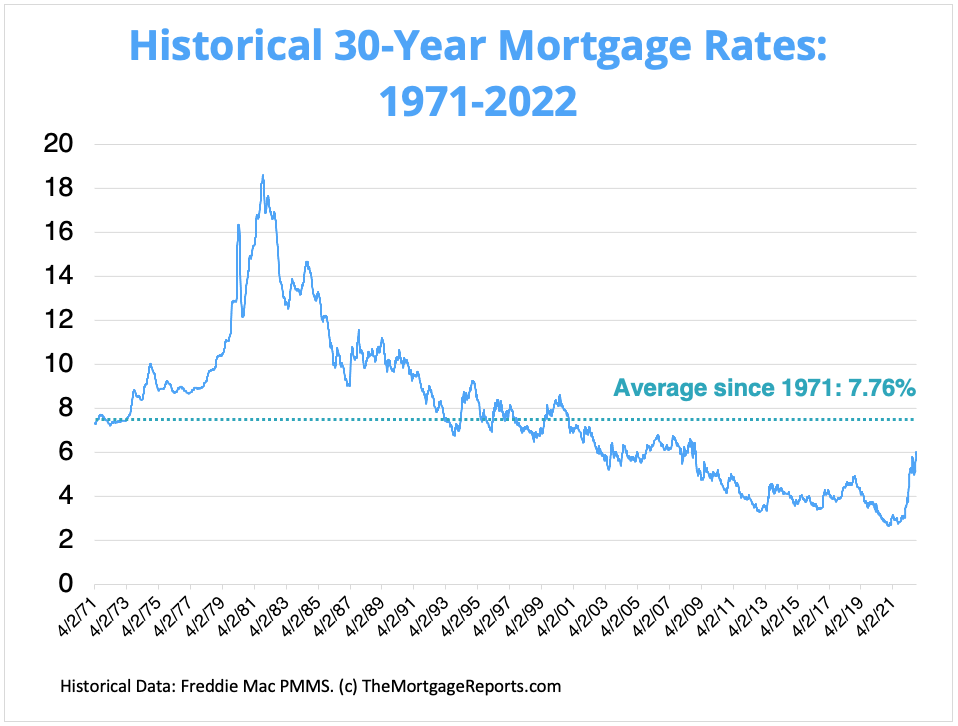

It is easy to get caught up in what the media says about dramatic rises in interest rates. No need to fear; mortgage rates are still far below the 30-year average at 7.76%. Let’s break down the numbers over the years to put in perspective how in today’s market, buying a home is still worth your while.

Breaking Down Interest Rates of The Past

In 1981 the rates peaked at 18.45%. The average interest rate that year was 16.63%. To give you a more accurate idea, let’s look at an example of a mortgage loan at the average interest rate from 1981. A $200,000 mortgage at 16.63% has a monthly cost for principal and interest of $2,800. If we compare that with the long-time average (7.76%), that’s an extra monthly cost of $1,300 or $15,900 per year.

Today, the rates are not just lower than the 1981 average of 16.63%, but they are below the 30-year average! That means you are still saving money on your mortgage compared to the almost 8% long-term average from the past 30 years.

Mortgage Payments Are Locked In, Unlike Rent Payments

More and more renters are feeling the effect of inflation. Plus, with the mass exodus from cities like San Francisco, renters are seeing the effects on prices. Landlords in the Greater Sacramento, Tahoe, and Reno Areas can charge much higher prices with larger selections of possible tenants. The good news is that you don’t have to be subject to raising rent prices.

When you purchase a home, you lock in the price, month after month, year after year, and eventually, you’ll no longer have a mortgage payment. When you continue renting, you are subject to your landlord’s price increases. Take a look at our blog Renting vs. Buying: A Breakdown of the Numbers to learn what waiting to buy will cost you.

Lower Your Mortgage Rate

We get it; it can be scary to buy when mortgage rates are higher than they were. Many homebuyers worry that rates will drop and they will miss out. Remember, you don’t have to be stuck with your mortgage loan forever. You can always refinance to cut your monthly costs if rates drop significantly.

Prices Will Continue To Increase

It is easy to get caught up in what the media has to say about dramatic rises in interest rates. The truth is, there will never be a better time to buy than when you are financially ready to buy a home, no matter what the interest rate is. The cost of goods has always gone up and will continue to rise. Homes are no different. As you wait to buy, the price of labor and supplies will continue to increase.

The good news is that we here at Tim Lewis Communities are ready to help you buy the home of your dreams. Plus, when you partner with our preferred vendors and us, we can work with you on interest-rate buydowns. This will allow you to get an even lower rate on the house of your dreams. Contact our preferred lenders today to see what you are approved for.

Start Your Journey to a New Home!