Renting vs. buying has been a big topic over the past few years. With the housing market on a drastic rise since 2020, people are hesitant to buy in such a seller’s market. Sacramento homes are up 22.3% from 2020 to 2021, leaving many people waiting for the “housing bubble to pop.”

What if the bubble doesn’t pop? Housing prices are not rising as dramatically, but are still increasing, with no sign of stopping. According to the Los Angeles Times, prices will continue to rise, just at a slower pace.

Buy Now or Continue Renting?

So here is your question, will you continue to rent or will you buy?

Housing prices are continuing to rise, but so are rental prices. Sacramento saw an increase of 18% in rental prices in 2021 alone, and rent is continuing to climb.

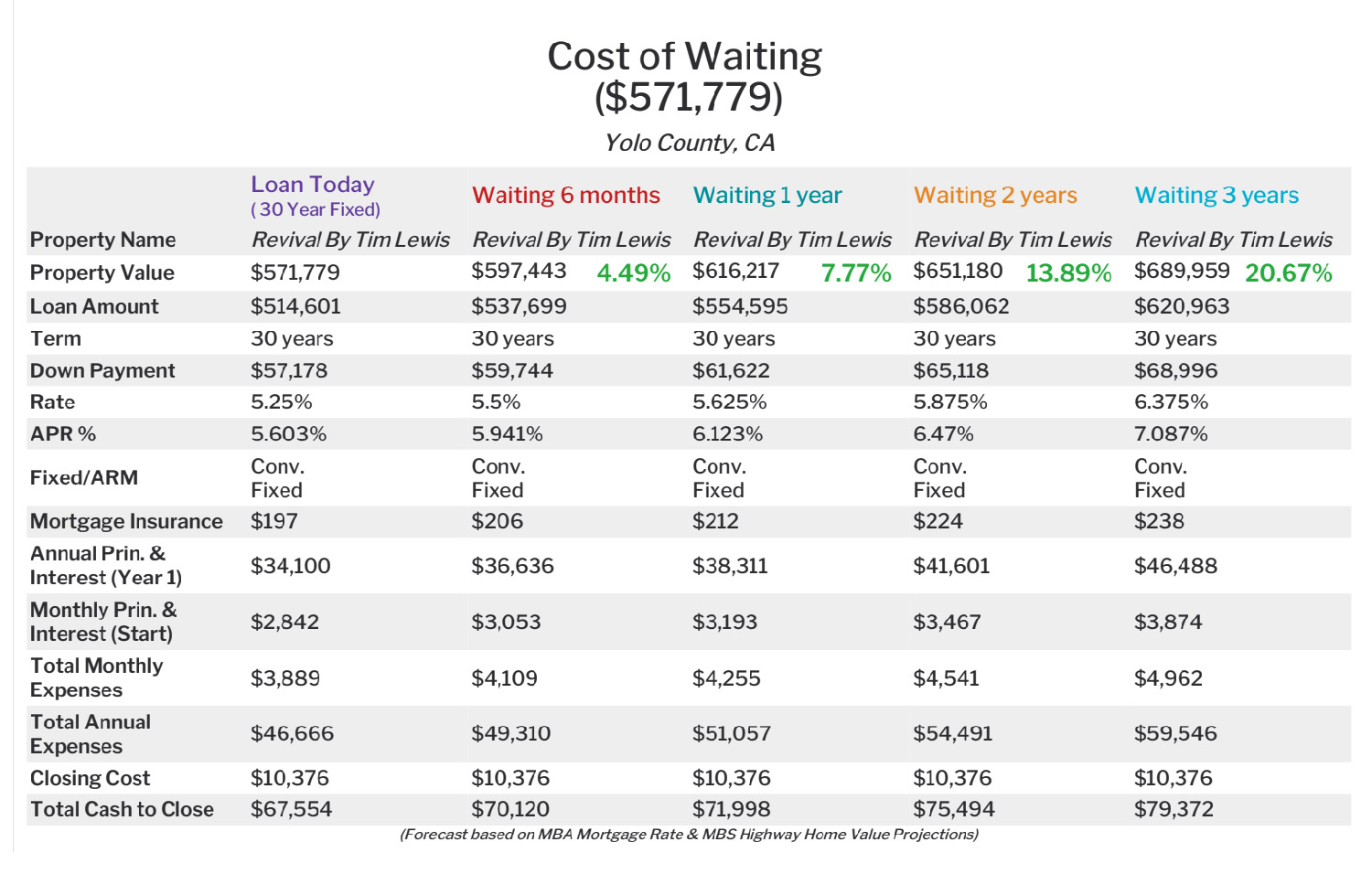

It is hard to see the difference long-term between buying and renting without seeing the dollars and cents to back it up. Percentages are great, but it makes all the difference when the amount can be put into monetary value. We broke down the numbers so you can get the big picture view of the cost differences of waiting to buy and buying now.

Revival Homebuyer

This scenario is from one of our Revival homeowners buying a home for $609,922.

Buying A Home Now or Forever Renting

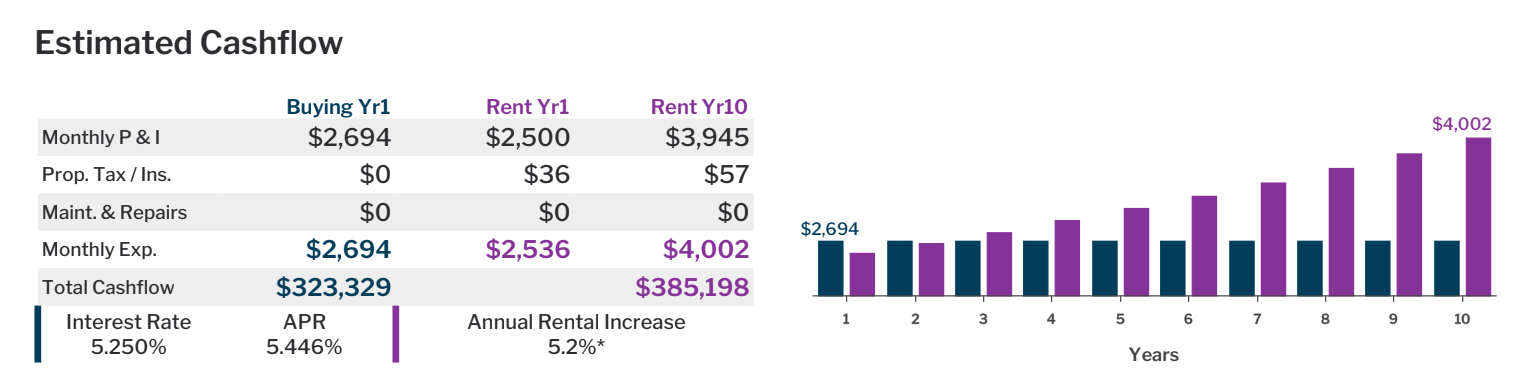

In May 2022, monthly payment and interest is $2,694. In May 2032, their monthly payment and interest are still $2,694. If these homeowners had continued renting at their $2,500 a month payment, they would have been paying $3,945 a month by May 2032, with the average annual rent increase of 5.2%. This is a cash flow difference of $61,869! Take a look at our chart below to see the expenses increases.

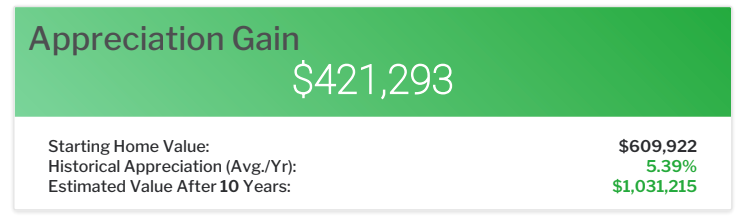

Not only are the Revival homeowners paying less per month than they would if they continued renting, but their home will continue to appreciate. From the purchase in May 2022, the home is estimated to increase in value at 5.39% per year. By May 2032, the home is estimated to be valued at $1,031,215.

Buying A Home Later

You may still be hoping there is a “housing bubble” causing a dip in the market, but waiting may cost you even more. The cost of waiting could cost hundreds of thousands of dollars. Take a look at our chart for our Revival homeowner in May 2022.

The Time to Buy is Now

The market may be cooling off, but it is not stopping. Housing prices will continue to rise, and rental prices will follow suit. Locking in your monthly payments and building equity in a home will not only save you money but will eventually make you money.

Start our pre-approval process today with one of our financial partners and start living the homeowner’s dream.