As we welcome the new year, it’s an excellent opportunity to look at the market and understand what 2023 will bring. When we consider the health of the current housing market, we look at several different factors:

- Mortgage rate

- Home prices

- Homeownership rate

- Supply and demand

For this blog, we’re going to dive deeper into mortgage rates and home prices to provide an overview of the current market as well as give an idea of where things might go in 2023. Of course, it’s important to note that while it would be nice to have a crystal ball view into the future, everything we’re discussing here is only predictions and forecasts. Let’s look at what’s on the horizon for 2023’s housing market.

Interest Rate & Mortgage Rate Predictions

Although interest rates are still increasing – with another half-point rate hike in the middle of December – this rate increase was the smallest amount in the past seven months. The Federal Open Market Committee (FOMC) has brought interest rates back to levels not

seen since late 2007 and early 2008 (4.25% – 4.5%). This means interest rates have roughly doubled from their lows in early 2022. What does this mean for the housing market?

To start, we can be sure that people will continue to buy and sell homes in 2023! According to Nick Bailey, president and CEO of RE/MAX, LLC, “…the truth is, people are getting married, divorced, moving to care for aging family members, relocating for career opportunities and so on, every single day. And for those people, it’s less about the interest rate or mortgage rates that week and more about their present situation and whether they can afford a house that fits their needs.”

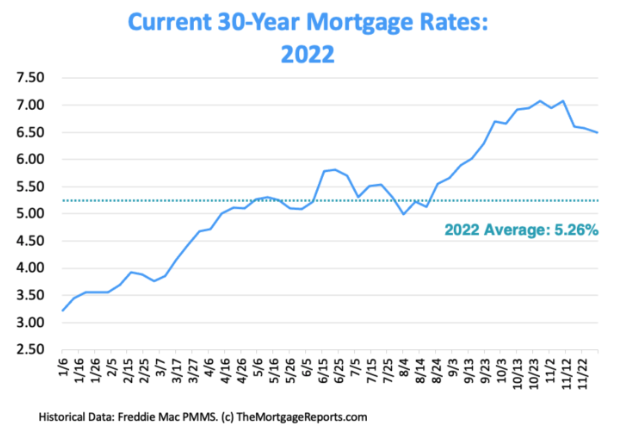

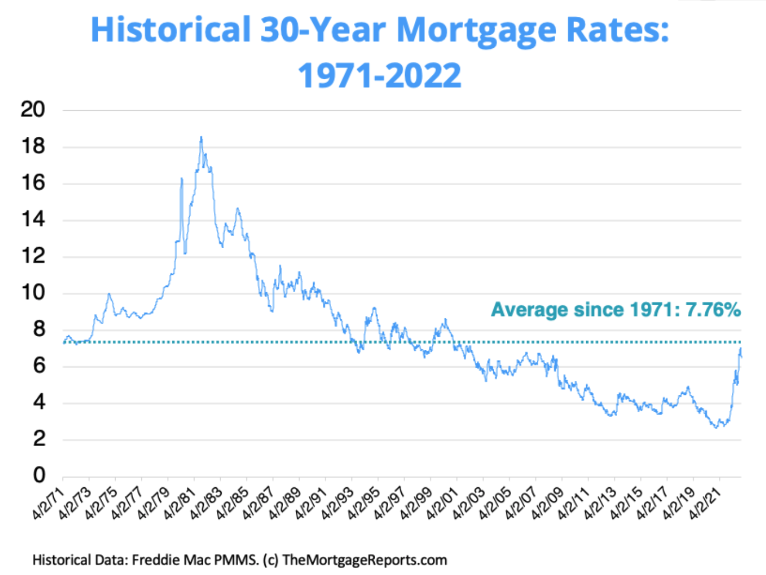

Additionally, although mortgage rates have increased to their highest levels since 2002 (see the above chart), according to Fed Chair Powell, we could see a leveling-off or decline in the future. As we can see from the below chart, we know that interest rates will continue to fluctuate. We also know that housing costs will continue to rise. According to RenoFi, housing prices in the U.S. have increased by 48.55% over the past 10 years. Regardless of the fluctuation of interest rates, the best time to buy a home is right now!

It’s also worth noting that although interest rates continue to increase, they’re still below the 30-year average (see the above chart).

Available Homes

According to the California Association of Realtors (CAR), we can likely expect a market shift as higher interest rates affect housing demand. Some of the numbers worth noting are that existing, single-family home sales are forecast to total 333,450 units in California in 2023, a decline of 7.2% from 2022’s projected pace. It’s also worth noting that housing affordability (the % of households who can afford a median-priced home) is expected to drop to 18% in 2023 from a projected 19% in 2022. So what does all this mean for prospective homebuyers? In the coming year, there will still be a limited number of homes available, so prices are unlikely to drop due to demand.

If all these interest rates and housing market fluctuations are driving you crazy, you’re not alone! That’s why as a potential homeowner and borrower, it doesn’t make sense to try to time your rate in this market. The best thing you can do is to buy a home when you’re financially ready and can afford the home you want – regardless of current interest rates. Everything we’ve discussed is just a prediction, and the one thing we can guarantee is that the housing market is constantly increasing, which is why now is an excellent time to buy a new home!

If you’re ready to buy a new home, we recommend contacting one of our preferred lenders – U.S. Bank or Safe Credit Union – to find out how you can get pre-qualified! Partnering with one of our preferred lenders means we can work with you on interest-rate buydowns, allowing you to get an even lower rate on your dream home! It’s also important to note that you can always refinance later down the road. If you feel ready, contact our preferred lenders today to see what you’re approved for!