The media has been talking for months about a housing bubble. With the increases in home prices, low mortgage rates, and high housing demand from 2020 to 2022, some experts worried that the market may be overheating and that a new bubble could be forming. However, others argue that the market has learned from the lessons of the past and that the current growth is sustainable. Join us as we debunk the myths of the past and lay out the facts about the current housing market.

History of the Housing Bubble

When people speak of a housing bubble, they are referring to 2008 in the United States. This was a period of time that involved rapid and unsustainable growth in the housing market that eventually led to a financial crisis and economic recession. The bubble started to form in the early 2000s, as low-interest rates, relaxed lending standards, and increased investment in the housing market fueled a surge in home prices.

During this time, many people took advantage of the low-interest rates and lenient credit policies to purchase homes, often using adjustable-rate mortgages that initially offered low monthly payments but could later adjust to much higher payments. This led to an increase in demand for homes, which in turn caused prices to rise rapidly.

However, the housing bubble eventually burst, as rising interest rates and an increase in foreclosures caused home prices to decline and the market to collapse. The decline in housing prices led to a reduction in consumer spending, which in turn impacted the larger economy. Additionally, the widespread use of complex financial products such as mortgage-backed securities, which were based on the value of subprime mortgages, resulted in significant losses for financial institutions and investors, contributing to the financial crisis.

The housing bubble and financial crisis had far-reaching impacts, leading to widespread job losses, a decline in consumer spending, and a decline in the overall economy. It also led to stricter lending standards.

How Today’s Market is Different

While some experts may say we are headed toward a housing bubble, the facts say otherwise. There are four crucial differences from 2008 to today.

- Lending Standards: Lenders have become much more cautious in their lending practices since the financial crisis, and many now require higher credit scores and larger down payments from borrowers. The types of mortgage products available today are different from those that were widely used during the housing bubble. For example, adjustable-rate mortgages and subprime loans, which were significant contributors to the financial crisis, are now less common and subject to stricter regulations.

- Home prices: While home prices have increased in recent years, they have not reached the same levels as they did during the housing bubble in 2008. Additionally, the growth in home prices has been more sustainable, reflecting underlying fundamentals such as job growth and low-interest rates.

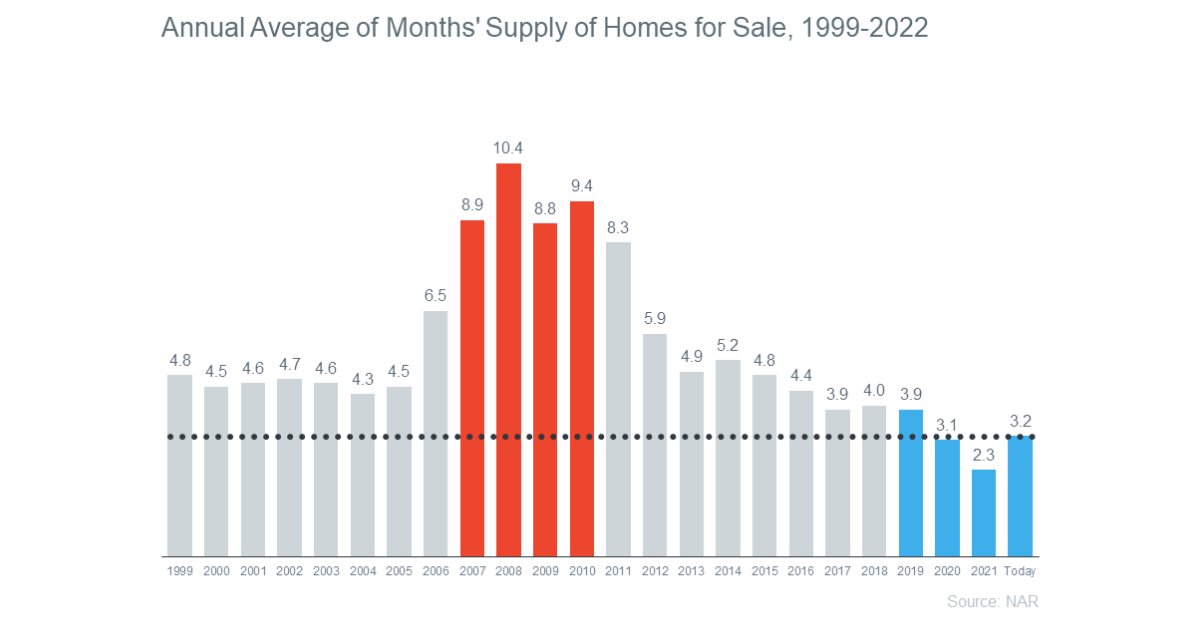

- Inventory: The supply of available homes is lower today than it was in 2008. New construction was more prevalent in 2008, with builders actively constructing new homes to meet the high demand. Today, new construction is slower as builders have become more cautious and are focused on building homes in markets with strong demand.

- Foreclosures: Foreclosures were much more common in 2008, as many homeowners were unable to keep up with their mortgage payments. Today, foreclosures are less common, as lenders have become more cautious in their lending practices, and the economy has improved.

Overall, the housing market today is in a much stronger position than it was in 2008, with a more stable foundation and fewer risks. However, it is always important to be aware of potential risks and to make informed decisions when buying or selling a home.

Don’t Wait for A Bubble To Pop

Sorry to burst your bubble, but with the differing factors from 2008 to 2022, the chances of a housing bubble are slim. While you may worry about factors such as interest rates, changes in the economy, and changing home prices, our team of experts at Tim Lewis Communities is here to help. We have great incentives on quick-move-in homes as well as an amazing team of preferred lenders who can help you find the best mortgage loan for your family. Let us take the stress out of timing the market and get you into your dream home today!